How Do You Record A Fixed Asset . when to classify an asset as a fixed asset. fixed assets should be recorded at cost of acquisition. we’re going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal. a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. the accounting for fixed assets includes the initial asset recordation, asset depreciation, asset disposal, and asset. The practice details the lifecycle of an asset, such as purchase,. Cost includes all expenditures directly related to the acquisition or construction of and the preparations for. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. When assets are acquired, they should be recorded as fixed assets if they.

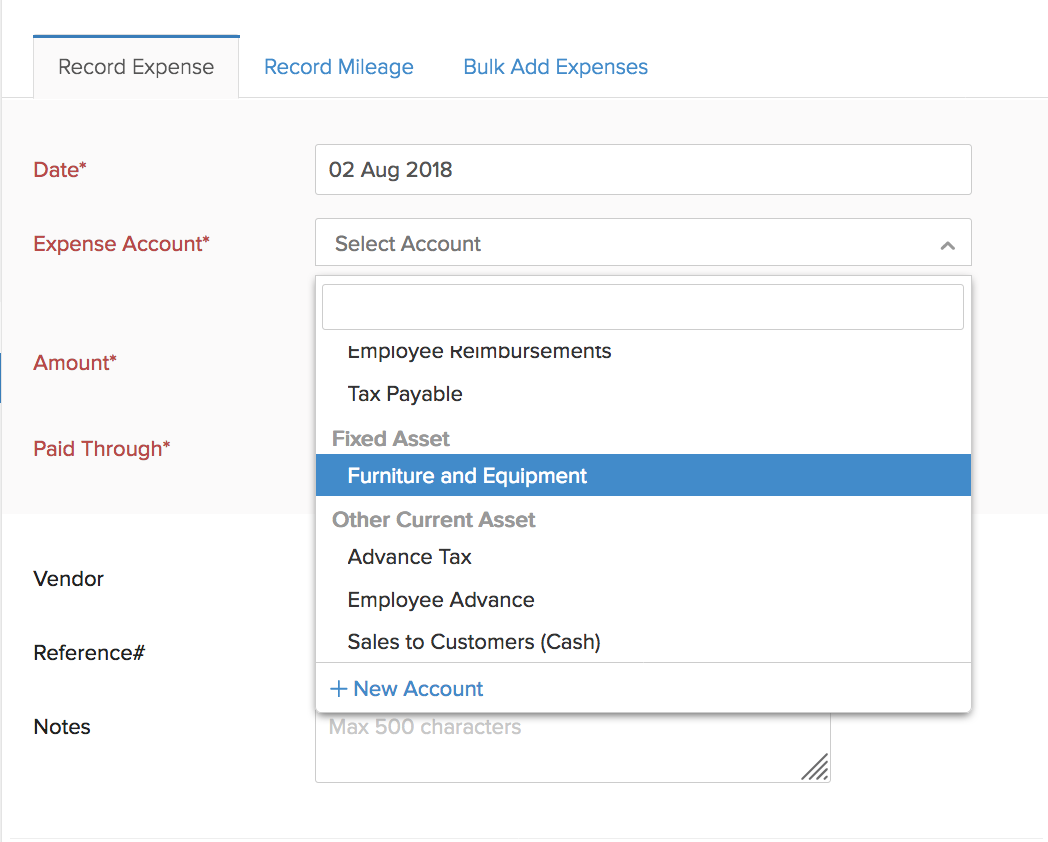

from www.zoho.com

the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. the accounting for fixed assets includes the initial asset recordation, asset depreciation, asset disposal, and asset. when to classify an asset as a fixed asset. When assets are acquired, they should be recorded as fixed assets if they. we’re going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal. The practice details the lifecycle of an asset, such as purchase,. a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. Cost includes all expenditures directly related to the acquisition or construction of and the preparations for. fixed assets should be recorded at cost of acquisition.

Fixed Assets FAQ Zoho Books

How Do You Record A Fixed Asset fixed assets should be recorded at cost of acquisition. we’re going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal. fixed assets should be recorded at cost of acquisition. Cost includes all expenditures directly related to the acquisition or construction of and the preparations for. the accounting for fixed assets includes the initial asset recordation, asset depreciation, asset disposal, and asset. a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. when to classify an asset as a fixed asset. When assets are acquired, they should be recorded as fixed assets if they. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. The practice details the lifecycle of an asset, such as purchase,.

From ufreeonline.net

50 How To Record Fixed Assets How Do You Record A Fixed Asset a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. we’re going back to the basics in accounting, and. How Do You Record A Fixed Asset.

From financiallearningclass.com

FIXED ASSETS Financial Learning Class How Do You Record A Fixed Asset a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. Cost includes all expenditures directly related to the acquisition or construction of and the preparations for. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or. How Do You Record A Fixed Asset.

From ufreeonline.net

How to Record Fixed assets Lovely How to Record Construction In Progress Cip In Dynamics How Do You Record A Fixed Asset the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. The practice details the lifecycle of an asset, such as. How Do You Record A Fixed Asset.

From ufreeonline.net

50 How To Record Fixed Assets How Do You Record A Fixed Asset When assets are acquired, they should be recorded as fixed assets if they. The practice details the lifecycle of an asset, such as purchase,. a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. Cost includes all expenditures directly related to the acquisition or construction of and the preparations. How Do You Record A Fixed Asset.

From dribbble.com

How to Record Fixed Assets in QuickBooks Online? by Paul Bryant on Dribbble How Do You Record A Fixed Asset fixed assets should be recorded at cost of acquisition. When assets are acquired, they should be recorded as fixed assets if they. The practice details the lifecycle of an asset, such as purchase,. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a. How Do You Record A Fixed Asset.

From mudabicara.com

What are Fixed Assets? Definition, Types, How to Record and Examples How Do You Record A Fixed Asset The practice details the lifecycle of an asset, such as purchase,. when to classify an asset as a fixed asset. the accounting for fixed assets includes the initial asset recordation, asset depreciation, asset disposal, and asset. fixed assets should be recorded at cost of acquisition. When assets are acquired, they should be recorded as fixed assets if. How Do You Record A Fixed Asset.

From ufreeonline.net

50 How To Record Fixed Assets How Do You Record A Fixed Asset a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. we’re going back to the basics in accounting, and. How Do You Record A Fixed Asset.

From www.slideserve.com

PPT How do you record a loan payment for fixed asset in quickbooks? PowerPoint Presentation How Do You Record A Fixed Asset a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. The practice details the lifecycle of an asset, such as. How Do You Record A Fixed Asset.

From efinancemanagement.com

Fixed Asset Accounting Examples, Journal Entries, Dep., Disclosure How Do You Record A Fixed Asset when to classify an asset as a fixed asset. When assets are acquired, they should be recorded as fixed assets if they. fixed assets should be recorded at cost of acquisition. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit. How Do You Record A Fixed Asset.

From precoro.com

🏢 How to Record Fixed Assets in QuickBooks Online [Guide] How Do You Record A Fixed Asset The practice details the lifecycle of an asset, such as purchase,. when to classify an asset as a fixed asset. When assets are acquired, they should be recorded as fixed assets if they. a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. the basic entry to. How Do You Record A Fixed Asset.

From ufreeonline.net

50 How To Record Fixed Assets How Do You Record A Fixed Asset we’re going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset journal. when to classify an asset as a fixed asset. fixed assets should be recorded at cost of acquisition. the basic entry to record a fixed asset is a. How Do You Record A Fixed Asset.

From ufreeonline.net

50 How To Record Fixed Assets How Do You Record A Fixed Asset fixed assets should be recorded at cost of acquisition. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash. When assets are acquired, they should be recorded as fixed assets if they. The practice details the lifecycle of an asset,. How Do You Record A Fixed Asset.

From civil4m.com

Format for record of fixed assets of construction company for Machinery Civil4M How Do You Record A Fixed Asset When assets are acquired, they should be recorded as fixed assets if they. fixed assets should be recorded at cost of acquisition. when to classify an asset as a fixed asset. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit. How Do You Record A Fixed Asset.

From www.youtube.com

How to record fixed assets in quickbooks desktop YouTube How Do You Record A Fixed Asset a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. The practice details the lifecycle of an asset, such as purchase,. we’re going back to the basics in accounting, and the objective of this post is to walk you through the correct way to book a fixed asset. How Do You Record A Fixed Asset.

From support.expenseplus.co.uk

How do I record a fixed asset purchase? ExpensePlus Help & FAQ How Do You Record A Fixed Asset the accounting for fixed assets includes the initial asset recordation, asset depreciation, asset disposal, and asset. Cost includes all expenditures directly related to the acquisition or construction of and the preparations for. When assets are acquired, they should be recorded as fixed assets if they. the basic entry to record a fixed asset is a debit to the. How Do You Record A Fixed Asset.

From www.youtube.com

Disposals of Fixed Assets and how to record in T accounts? YouTube How Do You Record A Fixed Asset a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. When assets are acquired, they should be recorded as fixed assets if they. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a. How Do You Record A Fixed Asset.

From www.sqlaccounting.sg

How to Record Fixed Asset Depreciation SQL Account How Do You Record A Fixed Asset fixed assets should be recorded at cost of acquisition. a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. the basic entry to record a fixed asset is a debit to the fixed asset class category, such as property, plant, or equipment, and a credit to cash.. How Do You Record A Fixed Asset.

From www.youtube.com

How to record Fixed Asset (Furniture) Purchase in QuickBooks Online YouTube How Do You Record A Fixed Asset a quick reference for fixed assets journal entries, setting out the most commonly encountered situations when dealing with fixed assets. the accounting for fixed assets includes the initial asset recordation, asset depreciation, asset disposal, and asset. we’re going back to the basics in accounting, and the objective of this post is to walk you through the correct. How Do You Record A Fixed Asset.